Do you know the essentials of Retirement Planning

A survey by IMRB International shows that India’s per capita retirement and pension assets as a percentage of Gross Domestic Product (GDP) is among the lowest compared to other economies like Germany, USA and Brazil. The survey also reveals that Indians generally do not focus on retirement planning and mostly depend on the accumulated savings received from their respective employers post retirement.

India has only 15.1% of retirement assets (as a percentage of GDP) as compared to 78.9% in USA, 41% in Brazil and 21% in Germany.Though India is comparatively a young nation with the median age of the population under 30 years, we also have around 100 million people above the age of 60 years. This is expected to triple to 300 million by 2050. That is why it is very retirement planning becomes very important for all of us.

What is retirement?

Retirement is explained as a phase in your life when you stop working and stop earning a regular income. As a salaried employee, you are discharged from your duties after the pre-specified retirement age (in India, which is usually when you reach 58-60 years of your age). Even if you are an entrepreneur, you cannot work forever and plan your succession. Once you pass on the responsibility to your successor, you can be called as retired.

However, the question is whether you were in a job or an entrepreneur what do you do when your income stream dries up? Does your expense stop too? Obviously not! If they don’t, how do you live a happy retired life without any savings at your disposal?

The answer is a certain ‘NO’. You can’t live a good life post retirement until you have known what retirement planning is at an early age when you started your career or earning. But unfortunately, inIndia most of us either plan for retirement at a very late age or not plan at all assuming whatever we have accumulated so far will take care of our retirement years.

Then what should we do?

Know your post retirement expenses and save for it

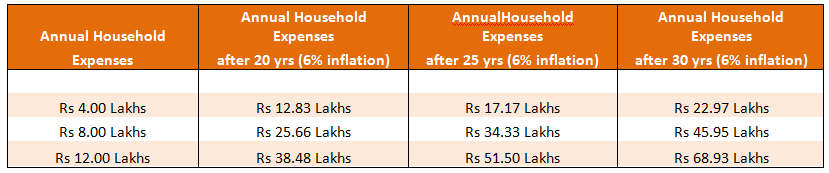

During the working phase of our lives, we worry about earning more and spending more, invest in physical assets and busy fulfilling our social and moral responsibilities.We also make a budget and allocate earnings carefully. However, as we earn or get monthly salaries and an annual increment we do not notice the devil called ‘inflation’. But while doing our retirement planning, we must not ignore this devil called ‘inflation’. Let us see how inflation can have a big impact on your monthly expenses post retirement .

As you can see in the above chart, if your current annual household expenses is Rs 8 Lakhs it could shoot up to Rs 25.66 Lakhs, Rs 34.33 Lakhs or Rs 45.95 Lakhs, after 20, 25 and 30 years respectively, depending upon after how many years your retirement life will start!

The important point here is that you should start saving for the targeted amount or corpus (inflation adjusted) and not today’s amount. But what is the target corpus amount? The target corpus amount is something, keeping which in a safe investment you can earn the amount required for your annual expenses.

How to accumulate the target corpus amount? If you start saving monthly from an early age into Unit linked insurance plans then accumulating the targeted corpus is easy.

Start savings early in life

This is the most important part of retirement planning. If you plan for retirement that is not enough, even saving for retirement may not be enough. The most important thing is staring the retirement saving as early in life as possible.

Let us understand through an example –

Mohan (Age 28), Somnath (Age 35) and Karthick (Age40), are working in a company and all three are planning to save for an equal retirement corpus, i.e. Rs 3 Crores. All will retire at the age of 60.

- Mohan need to save Rs 14,000 per month till age 60 to reach the target corpus of 3 Crores, assuming return on investment @9%

- Somnath need to save Rs 27,000 per month till age 60 to reach the target corpus of 3 Crores, assuming return on investment @9%

- Karthick need to save Rs 44,000 per month till age 60 to reach the target corpus of 3 Crores, assuming return on investment @9%

As you can see, Mohan need to save the least as he has more number of years in hand. Somnath need to save almost the double amount as he has 7 years less to save. And Karthick need to save almost the double amount than Mohan as he has only 20 years to save.

Review and select a good plan for medical expenses

With old age come various kinds of ailments, some minor and some major. It could be very difficult to pay huge hospital bills in case of hospitalization as you no longer have a regular income or reimbursement of medical expenses from your employer

Buying a health insurance plan covering the major critical illnesses along with aMediclaim plan is must for self and spouse. There are health plans which are renewable lifelong and you should invest in one immediately.

You can avail a health insurance plan covering critical illness and disability, from a life insurance company

Set aside contingency funds

Contingencies can come in any form, you or your spouse falling ill, a serious sickness or a sudden travel or an expense that you have to commit for marriage of someone very dear or so on. What do you do in a situation like this?

You should save for a contingency or emergency fund. You can either create an emergency fund from your final retirement corpus or can save separately from an early age. You can invest in ULIP plans which offer low risk debt portfolios and keep it aside for meeting your emergency expenses post retirement.

Choose the right Retirement Plans

Just retirement planning or investing in a medical insurance will not help. You must ensure to invest in certain plans which help you magnify your savings i.e. help you in creating wealth in order to help you lead a dignified life post retirement.

If you are planning a secured retirement life then investing in a good retirement plan is important. Many insurance companies provide various pension plans such as deferred annuity, immediate annuity, with cover and without cover plans, life annuity, pension funds etc.

Retirement plans offered by life insurance companies are such plans wherein the insurance company provides a stream of annuity payouts to the policyholder. Such annuity payouts are made out of the funds contributed by the policy holder either in lump sum or in monthly, quarterly or annual instalments depending on the pension plan chosen. Month or annual annuity payouts are made during the lifetime of the policyholder. Post his expiry, the annuity payouts normally stops, but, in many pension plans, the annuity payouts continue to be paid to the nominee even after the policyholder’s death.

During our retirement years, when we stop earning and start a new life called ‘golden years’, a regular income through savings made during working years could be the most ideal situation. So, in order to make retirement life happy, healthy and enjoyable we must make proper retirement planning in order to take care of our retirement years.

Comments