Growth vs Value stock

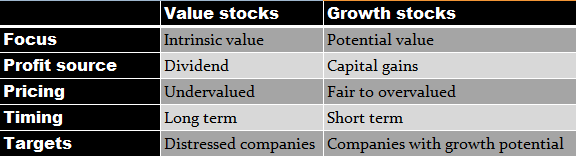

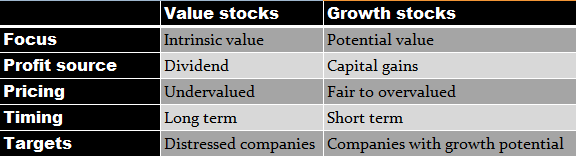

In stock market everyone wants to buy low and sell high, but there is always a confusion as to what is low and high. This is how the stock market works as there has to be a buyer for every seller and vice versa. Basically there are two types of investors based on their stock picking namely growth stocks and value stocks. Similarly in mutual funds, you will come across this two labels- Value funds and Growth funds. The difference however lies in their method of stock picking and the approach they employ for the same.

Growth investing

Growth stocks are linked with high quality, good companies where you expect the earnings to grow at a higher pace vis-a-vis general market. These stocks often tend to have higher P/E ratio and higher P/B ratio. For instance, the current price is trading at Rs 100 and the EPS over the last 12 months is Rs 2.5, so the PE ratio stands at 40.

Generally, the market places a high value on growth stocks as they believe these stocks have great potential going forward and hence ready to pay more price for such stocks.

Growth fund often invests in companies which managers believe will experience faster growth than its peers in terms of cash flow, top line and bottom line. These managers are very concerned about the way company manages its business like these companies instead of paying out dividend, often likes to reinvest its profit for acquisitions and further expansion.

These growth funds vis-a-vis value funds often carry very high risk even though they are potential of generating higher returns. Growth stock tends to perform well when the overall market is performing well and often underperform when market falls. Hence, growth stocks are mostly for risk seeking investors and risk averse investors should avoid.

Value investing

Value stocks have a general tendency to trade at a lower price as compared to its fundamentals. Some of the common features of these stocks are Low P/E ratio, low P/B ratio and high dividend yield. Click here to learn in detail that how to conduct equity research analysis.

Value investor usually looks for these kinds of stocks which are trading at a discount to their true valuation or commonly known as intrinsic value (calculated based on their future projected earnings). The reason for such mismatch is inefficiencies in stock market in short term, but in the long term market, will automatically catch up to its true valuation. These stocks tends to do well when the economy starts accelerating after a recession and the earnings of such stocks often fluctuates

Growth investing

Growth stocks are linked with high quality, good companies where you expect the earnings to grow at a higher pace vis-a-vis general market. These stocks often tend to have higher P/E ratio and higher P/B ratio. For instance, the current price is trading at Rs 100 and the EPS over the last 12 months is Rs 2.5, so the PE ratio stands at 40.

Generally, the market places a high value on growth stocks as they believe these stocks have great potential going forward and hence ready to pay more price for such stocks.

Growth fund often invests in companies which managers believe will experience faster growth than its peers in terms of cash flow, top line and bottom line. These managers are very concerned about the way company manages its business like these companies instead of paying out dividend, often likes to reinvest its profit for acquisitions and further expansion.

These growth funds vis-a-vis value funds often carry very high risk even though they are potential of generating higher returns. Growth stock tends to perform well when the overall market is performing well and often underperform when market falls. Hence, growth stocks are mostly for risk seeking investors and risk averse investors should avoid.

Value investing

Value stocks have a general tendency to trade at a lower price as compared to its fundamentals. Some of the common features of these stocks are Low P/E ratio, low P/B ratio and high dividend yield. Click here to learn in detail that how to conduct equity research analysis.

Value investor usually looks for these kinds of stocks which are trading at a discount to their true valuation or commonly known as intrinsic value (calculated based on their future projected earnings). The reason for such mismatch is inefficiencies in stock market in short term, but in the long term market, will automatically catch up to its true valuation. These stocks tends to do well when the economy starts accelerating after a recession and the earnings of such stocks often fluctuates

Value funds keep searching for such opportunities in their hard times where the stock price usually doesn’t reflect their true worth. There could be a number of reasons for this like poor quarterly earnings, the company or the sector is in hard times or impact due to an external event in the short term. The fund managers often look for margin of safety while buying the stocks which implies that the stock price is trading below its intrinsic value. Say the intrinsic value is quoted at Rs 500 and the market price of the underlying stock is quoting at Rs 200 i.e. ie current price is trading much below its true worth.

Key features

Growth stocks

a. Priced higher than the broader market

b. They are often less sensitive to economic condition than the broader market.

c. Track record of higher earnings growth.

Value stocks

a. Are usually priced lower

b. They are highly sensitive and carry more risk than the usual market.

c. The earnings are often subdued

Bottomline

For most investors, following any single approach of investing over a longer time frame may not provide any absolute advantage. Hence instead of following any single approach, they often go for a combination of value and growth stocks so as to strive for the best possible return. This would help investors to profit throughout various economic cycles where market favours either value or growth investing style.

Take care and keep learning!

Comments